Jeff Berwick From The Dollar Vigilante Is Predicting This Project Could Grow 1000%

He’s accurately picked a few BIG-TIME cryptos before.

He’s accurately picked a few BIG-TIME cryptos before.

Let’s just get something clear from the get-go.

I love Lucy.

That little ankle-biting scallywag is a straight-up killer.

No, but seriously. The Dollar Vigilante has to be one of my favorite web-video shows. Jeff is hilarious and charismatic, and watching him walk around Mexico with his side-kick Chihuahua Lucy ‘talking about banksters and Bitcoin and the apocalypse’ is usually how I like to wind down.

No, but like, seriously again. I’m not throwing Jeff (or Lucy) under the bus with that headline. It’s taken directly from Jeff and TDV’s report here.

What does that have to do with anything?

You see, aside from funny videos that make fun of Klaus ‘you will eat ze bugs’ Schwab, Jeff operates 2 newsletters, The Dollar Vigilante, and The Crypto Vigilante, which promise to have you;

SURVIVING AND PROSPERING DURING AND AFTER THE DOLLAR COLLAPSE

Seems dramatic, but you have to understand he’s serious. There’s a reason the dude has set himself up in Mexico. And apart from the jokes, he, like his Chihuahua sidekick, is a murderer when it comes to picking crypto wins.

You see, Jeff called Pirate Chain at $0.05. Then, sometime later, his TDV newsletter featured it to subscribers and, within a few months, Pirate Chain rose to $16! A total gain of over 30,000%!

Bitcoin was also one of Jeff’s picks, which he did publicly in this video way back in 2013. And if I recall correctly, he had picked it privately in 2011 at around about 3 bucks. It seems insane but that’s a 1,300,000% gain.

ETH was picked at $2 in 2016, seeing a whopping fat 145,000% gain. And then others. This is along with Jeff and his Dollar Vigilante's non-crypto-related stock picks.

Have I got your attention yet?

What’s the latest TDV Crypto Alert!?

Jeff and TDV’s latest pick is Equilibria (XEQ).

By the way, you can read Jeff’s report on Equilibria here for free.

Equilibria is an open-source project focused on creating a private and decentralized oracle solution for a multitude of use cases.

Some basic token info: XEQ is currently priced at $0.43 at the time of this writing with a market cap of $24 million and 55.6 million coins in circulation. Max supply is 77 million.

What’s so good about Equilibria?

Equilibria (XEQ) is a hybrid PoW / PoS system that promises to stop compromised information leaking out of smart contract platforms. Essentially; a private native chain oracle.

Hol’ up — what’s an oracle?

An oracle connects smart contracts and blockchains with the outside world. And vice versa.

Think of it as a bridge between the blockchain and the real world. Another way to wrap your brain around it if you’re tech-savvy is to think of it as an API.

For the non-tech-savvy, just watch this video.

You can ask the oracle to put information into your smart contracts and onto the blockchain. This could be price information, weather report data, or traffic reports.

The oracle takes data from the outside world and puts it onto the blockchain or into a smart contract so that data can be used.

Think of it like this. Let’s say you sell potatoes at the local farmer's market. You sell potatoes for $3 a bag. John your competitor also sells potatoes. But he’s at the other end of the market. You don’t always know if John is selling potatoes for higher or lower than you and you want to be able to compete. So you ask your friend Bob to go and look. Bob goes to look and comes back to tell you that John is selling his potatoes for $2 a bag and so now you reduce the price.

Bob is your oracle.

That’s about as simple an explanation as you’re gonna get.

Whos the competitor?

Equilibria’s main competitor at this time is Chainlink (LINK). There are others but they are lesser-known and lesser-used overall. Chainlink controls about 80–90% of the market cap when looking at oracle projects depending on what you read.

It has the potential to capture a significant portion of Chainlink (LINK)’s market share, as well as cement itself as the go-to oracle for private smart contract networks.

The problem with Chainlink is that, well, everything.

Chainlink is headquartered in the Cayman Islands under a company called SmartContract and was founded in September 2014 by Sergey Nazarov and Steve Ellis.

In 2017 SmartContract / Chainlink completed their Initial Coin Offering (ICO) with $32 million worth of their ERC-20 token.

Here is what Jeff has to say about Chainlink:

There is a maximum supply of 1 billion LINK tokens, and only about 45% of them are in circulation in the trading float. It is therefore a privately owned business, in which the majority of holdings are held privately by those who determine any protocol changes.

On top of that, Chainlink associates and works with the World Economic Forum (WEF). We all know what Satan Klaus and the WEF are all about… so imagine that all data on smart contract platforms are managed by them and their own private company!

They could rig countless things to their advantage! And this is surely their plan. They want to be the only source for data in the digital world. Over time many people will begin to realize this is dangerous.

But, that isn’t the main reason why we think Equilibria will be a large competitor to Chainlink. The largest reason is that Chainlink, like most cryptos, is not private and secure.

That’s enough about Equilibria’s competitor Chainlink. If you want to read more about the problems with Chainlink, check out this blog post by James Sangalli.

Back to Equilibria.

What makes Equilibria private?

Privacy is this thing you’ll notice I am a little obsessed with and this is for a few simple reasons.

[1] I sh*t with the door closed.

[2] I f*ck with the door closed.

[3] I don’t share my PIN.

I mean privacy really is that simple when you think about it. You don’t need philosophy, history, or some long-drawn-out lecture about privacy from a so-called ‘privacy researcher’ or ‘data-security expert’. You know the ones from the corporate world who sold you out these last two years and demanded your information…cos c*vid.

When Adam met Eve they were butt-f*cking-naked. I reckon if I had to guess, it took Adam about 3 seconds to realize he needed privacy (a pair of pants) after frolicking around and realizing boners are a thing.

Blockchains, smart contracts, and oracles are not private and even the ones that are, or claim to be, are not private by default. They are not created equal.

Though there are private systems. It's half of what I talk about!

Enter Monero.

With Monero every user is anonymous by default. The sender, receiver, and amount of every single transaction are hidden through the use of three important technologies: Stealth Addresses, Ring Signatures, and RingCT.

This is important to know because Equilibria is a fork of Monero.

Equilibria’s privacy stack?:

Every transaction you make is private and secure via ring signatures and stealth addresses.

Just like Monero.

Remember when the IRS offered 600K to anyone that could crack Monero? Haha, I do. That stupid bounty still exists because Monero has never been cracked.

What else is there to know?

It’s super early in the project.

Currently, XEQ is only being traded on one exchange, Trade Ogre, which is a no-KYC exchange with good volume on BTC-XEQ. I must say I’m a fan of the minimal and almost retro-like style of the user interface on Trade Ogre. Good work if you’re listening, fellas!

Equilibria offer a wrapped WXEQ version on the Ethereum Mainnet. I’m not gonna lie and pretend I know much about this, so you’ll have to do your own research and ask around. I’ve just never really messed around with wrapped tokens. You can find out more here.

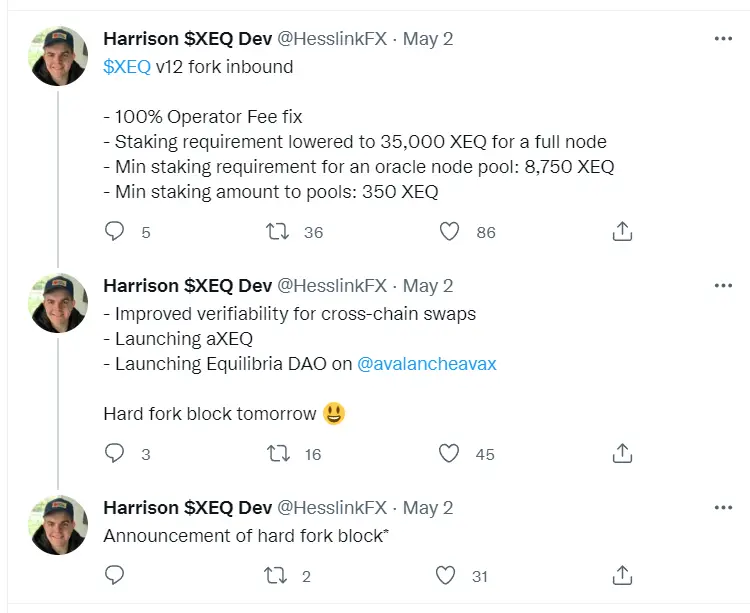

Some pretty big developments are coming (already happening) for Equilibria too. These were posted mere days ago by the developer Harrison Hesslink, take a look for yourself below or check his Twitter out here:

As always, tell me what you think.

Will XEQ skyrocket? Will it flop? Does Jeff need to ditch the polos and grab a pair of Jesus sandals instead?

Tell me what you think in the comments below.

Haven’t read the report yet. Grab a copy here for free.

Cheers,

Want to know how you can support Crypto Fireside?

Sign up below. It's free and easy 🔥.