🔥Crypto Fireside #3. Alessandro Grunwald From Sprout Pool

A Cardano Pool That Mints Blocks and Plants Trees.

A Cardano Pool That Mints Blocks and Plants Trees.

CF: Hello! Who are you and what do you do?

AG: My name is Alessandro. I am a back-end web developer from Vancouver BC (immigrated from Germany in 2009) and I am the creator & operator of Sprout Pool, a Cardano stake pool. My main goal is to run a reliable stake pool while educating people new to the crypto space through educational content on youtube and other social media outlets.

I went from learning what it means to run a stake pool to getting our pool’s first delegator in about 3 months; something I am super proud of and excited about. I have an extensive list of short and long-term goals that will elevate my project from being “just another stake pool” to being an essential hub for the community.

CF: Explain what a Cardano Stake Pool is.

AG: A Cardano stake pool is a cluster of servers responsible to process transactions for the Cardano network. Most of the time, someone is the owner/operator of a stake pool but anyone who owns ADA (Cardano’s currency) can choose to delegate their ADA to any of the available stake pools.

All “delegating” means is someone chooses to join (or “pool”) their ADA with others who picked the same stake pool. The collective amount of ADA helps the pool be more likely to be selected to “mint” a block (aka add a block of transactions to the existing blockchain).

If that happens, the network awards that pool and all its delegators with rewards in the form of ADA. The amount of rewards a delegator receives depends on the amount of ADA they hold in proportion to the total amount of ADA the pool has.

For example, if I own 10,000 ADA and delegate it to a stake pool that already has 90,000 total ADA delegated to it, we now collectively have 100,000 ADA. If that pool now mints a block and receives 1,000 ADA as a reward, I would receive 1/10 of those rewards, since that is the proportion of my ADA compared to the pool total. In reality, there are pool fees subtracted from those rewards first, but in essence, this is how it works conceptually.

CF: What’s your backstory and how did you become interested in Cardano and stake pools?

AG: I originally became interested in the cryptocurrency space during the bull run of 2017. I was really intrigued by the technology and the decentralized nature of it all (in Bitcoin’s case at least) and how it could affect the way we do finances in the future. During the market crash in March 2020, I took the opportunity and started investing in Bitcoin and a few smaller coins, one of them being Cardano. It was at that point that I started learning more about Cardano and the tech behind it. That’s when I realized its incredible long-term potential. It is built with such diligence, attention to detail, and a mission to change the world.

Apart from the exceptional technological foundation, another thing that attracted me to the project was the incredibly supportive community. Whether it be on Reddit, Twitter or Youtube, the Cardano community is one of the strongest out there in the crypto space. No matter what questions are brought up, there is no shortage of supportive community members ready to answer them; in great detail for that matter. While the stake pool space is rather competitive, most operators of larger pools are surprisingly supportive of newer operators, sharing their content and helping them raise awareness.

Lastly, thanks to my day-to-day job, I have a very strong foundational knowledge when it comes to server architecture and security. At this point, I felt confident in my ability to set up my own stake pool successfully. I also have a background in design and marketing, which helped me create an appealing brand image for my stake pool (at least in my opinion haha).

CF: Take us through the process of running and setting it all up.

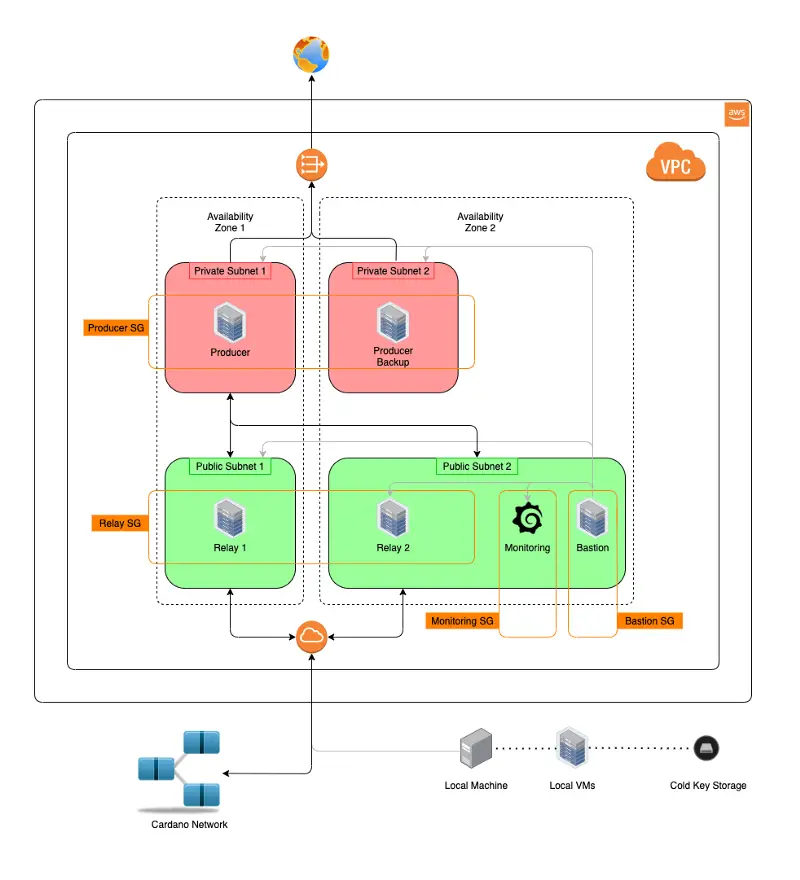

AG: At first I used IOHK’s (the company that built Cardano) documentation and laid out all server requirements and configurations needed. The way this is configured allows for multiple levels of security and redundancy; something that’s a top priority when running a stake pool.

AG: After designing the server architecture itself, I moved on to building and launching the actual infrastructure components on AWS. Once that was finished, I launched a test pool on Cardano’s testnet environment to test whether my configurations are set up correctly and working as intended. Now that I had confirmation about everything working properly, I was ready to design the pool logo and other marketing items.

CF: Describe the process of launching Sprout Pool.

AG: Now the hardest part of this whole process; launch and marketing my pool to the public. For this part, I spent some time analyzing what other pools were doing and attempted to stand out in how I market Sprout Pool.

I started by building an appealing/modern, but not too cluttered, website that people could go to and find all the information they could need about Sprout Pool. Next up was starting to produce educational/informative youtube content. While I don’t have the most outgoing/entertaining character, I felt that I could bring value to the community by making youtube videos both informative and technical in nature. This would help attract both the general public as well as more technologically savvy people to potentially staking with Sprout Pool.

Considering the incredible community Cardano has, I figured it could be beneficial to join some sort of stake pool operator community/association. This led me to CCSPA (Canadian Cardano Stake Pool Association); A group of like-minded pool operators from Canada. From the first meeting on, I felt welcomed and supported. It is a great place to get together and bounce ideas off of each other, as well as help each other get noticed by supporting one another’s social media content.

One thing I learned from the process of launching a stake pool is that you shouldn’t hesitate to ask others for help. For a lot of the pain points I had, someone else had a solution at hand. You should also not start with the mindset and expectation of becoming rich quickly; that ain’t going to happen. I am doing it solely as a hobby and a passion project. I am not expecting it to replace my day-to-day job (if it does, that’d be amazing of course) or help me make a quick buck. I simply want to be part of something that has the potential to change the world.

CF: Since launch, what has worked to attract and retain delegators?

AG: So far we only have one lone delegator, whose origin I’m not aware of. I’d like to think they may have watched one of my videos and felt like supporting my pool based on that, but who knows? Since I see decent engagement with my content, I will continue to do what I’m doing in that regard for the foreseeable future.

CF: How are you doing today and what does the future look like?

AG: Currently I am working on launching a loyalty program for Sprout Pool that includes different loyalty tiers, Cardano native tokens, and custom NFT art made by local artists. It is still very much a work in progress but once published, I think it will get people excited about joining and hopefully staying with my pool.

After the loyalty program has launched, I am planning to also release an NFT gallery solution. Currently, it is rather difficult for owners of NFT art to show off their prized possessions since it only lives on the blockchain in form of text and a link to a file on another decentralized file storage. That’s why I think it would be great to have a way to easily organize and share art through a web app format that doesn’t require people to register or download anything additionally.

Lastly, I am also looking into migrating from a cloud-based server infrastructure (Amazon AWS) to a localized, more decentralized setup using bare metal hardware and solar/wind power sources. This would further Cardano’s decentralized nature and also reduce the overall carbon footprint of the network as a whole.

CF: You mentioned moving away from AWS. I just finished interviewing Dimitar Dimitrov from SAFE. Have you considered combining Cardano with another project whose focus is decentralized web/storage?

AG: From what I understand about SAFE, it uses spare server resources from the public to operate a decentralized network that way. I am not sure how or if it would work with the Cardano network but certainly something that can be explored in the future. One thing that is already being utilized on Cardano is decentralized file storing using the IPFS protocol (https://ipfs.io/). It is currently the most commonly used method of saving files linked to native tokens and NFTs in the Cardano space.

CF: Through starting Sprout Pool, have you learned anything particularly helpful or advantageous?

AG: When working out where to start the whole process, I learned that there is no shortcut to this whole process. You should, no, you HAVE to spend the time and effort on understanding what it is you are doing. There are a ton of different guides out there that may work for some and not for others. Just trying to throw some servers together, installing the Cardano node, and advertising it will not get you very far. What if something breaks? What if you misplace your wallet keys and your entire pledge is locked away, never to be retrieved again? Those are some things that can and have happened to some pools in the past. Preparing for those scenarios is key to successfully starting up a Cardano stake pool.

CF: What tools do you use day-to-day?

AG: Currently both my testnet and mainnet pools are running on AWS ec2 instances located in Amazon’s data center in central Canada. They both are running Ubuntu 20.04 servers and have a variety of security features attached to them supplied by AWS’s wide variety of available tools. For developing my website and other additional projects, I use VS Code and Docker to most closely simulate the server environment those projects live on. To connect to the actual instances, I simply use Apple’s built-in terminal; nothing fancy is needed there.

CF: What have been the most influential books, podcasts, or other resources?

AG: Most influential for me were the YouTube channels of other pool operators, most notably, Damjan from EDEN pool. His tutorial videos helped me tremendously when I first got started. He only focuses on the technical aspect of it and never goes into any opinionated topics, which is not too common in the crypto youtube space.

CF: You said you’re a backend developer (you have a day job), how do you fit the stake pool operation in with life stuff?

AG: I am in a pretty fortunate position of having an incredibly supportive fiancée who allows me to work on my stake-pool-related projects after hours during the week. I do try to leave the weekends free for personal time but even then she tends to be okay with me continuing to work on my projects. She is invested in Cardano herself so she shares the same passion I have for Cardano’s mission.

CF: Advice for other creators, entrepreneurs, or developers who want to get started or are just starting out?

AG: I think the biggest mistake people make is trying to start their own pool with too little technical knowledge. It is important to have the technical know-how before you should consider even starting. Also, having unrealistic expectations is another pitfall. The stake pool space is a very long-term game and requires a lot of upfront expenses to get started. It is very unlikely (though not impossible) to quickly reach a point of profitability. It is easy to get discouraged, but as long as your pool is set up following best practices and you consistently add value to the community, delegators will want to support your cause and join your pool eventually. Keeping that up is the hardest part though and in my opinion, the main cause for pools to fail.

CF: Where do you see this entire space going in the next 5 years, 10 years?

AG: I have high hopes for Cardano and the crypto space in general. By directly working with the technology and learning about how everything is built, I am more confident than ever that Cardano will succeed. It may take a while, but it will eventually get there. I don’t really like making price predictions since I don’t really care too much about that, but if I HAD to make one, I would put Cardano at around $3 by the end of the year. There are lots of exciting things coming to the network in the next few months, including smart contracts, which will help it get to par with other smart contract projects such as Ethereum and Polkadot. There was also a recent announcement that the Ethiopian government will start utilizing the Cardano blockchain as the infrastructure behind their digital identification solution (aka DIDs) used by their educational system to securely store student records. This all makes me very excited for what’s to come.

CF: Where can we go to learn more?

https://twitter.com/sproutpool

https://www.youtube.com/channel/UCOt0K62r-7XweqlJXVt9gPA

https://www.reddit.com/user/sproutpool

CF: Thank you, Alessandro!

Want to know how you can support Crypto Fireside?

Sign up below. It's free and easy 🔥.